Sustainable Aviation Fuel Market Size to Worth USD 357.41 Billion by 2035 - Exclusive Report by Towards Chemical and Materials

According to Towards Chemical and Materials Consulting ™, The global sustainable aviation fuel market was estimated to be USD 2.31 billion in 2025 and is projected to reach USD 357.41 billion by 2035, at a CAGR of 65.56% during the forecast period.

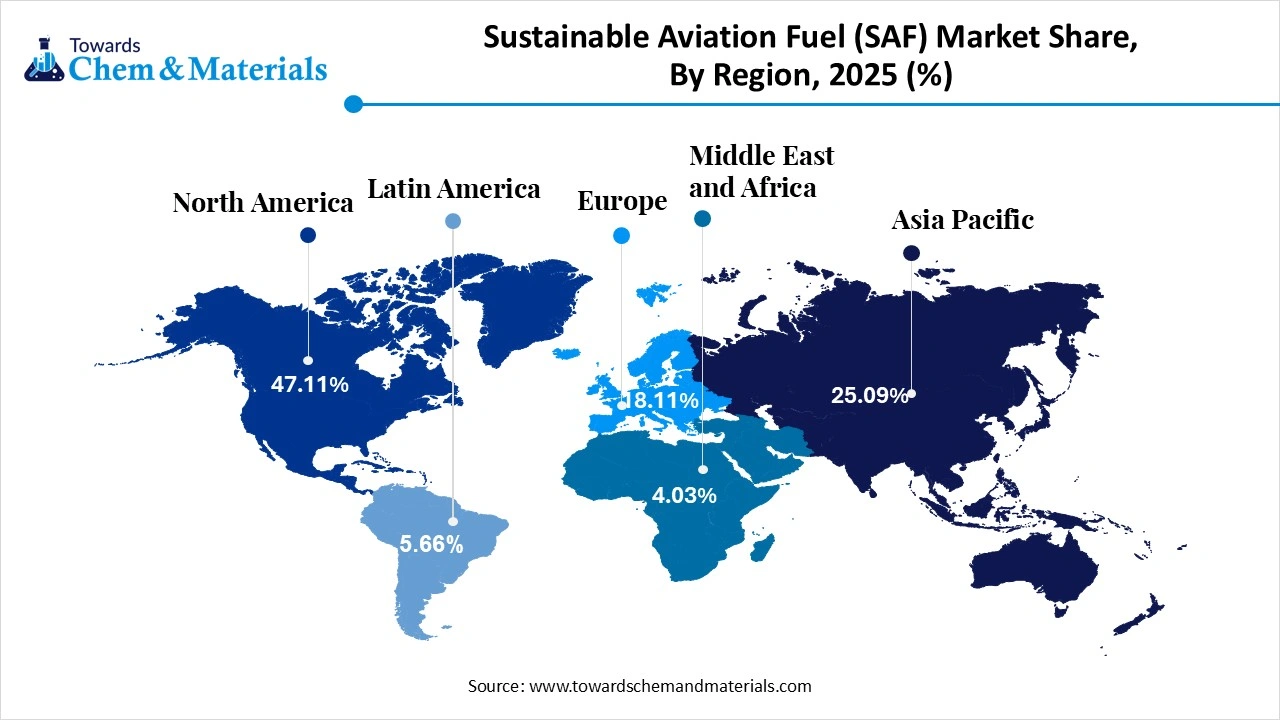

Ottawa, Dec. 10, 2025 (GLOBE NEWSWIRE) -- The global sustainable aviation fuel market size reached at USD 2.31 billion in 2025 and is predicted to increase by USD 3.82 billion in 2026 and is expected to be worth around USD 357.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 65.56% over the forecast period 2026 to 2035. Asia Pacific dominated the Sustainable Aviation Fuel market with the largest revenue share of 47.11% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6066

What is Sustainable Aviation Fuel (SAF)?

The sustainable aviation fuel market is expanding as airlines and regulators push for lower-emission alternatives to conventional jet fuel. SAF, produced from renewable and waste-based feedstocks, is gaining traction because it can be used with existing aircraft and fuelling systems. Supportive policies, rising sustainability commitments, and growing investment in advanced bio refineries are accelerating adoption. Commercial aviation remains the primary user, and both direct airline purchases and blended distribution channels are shaping the market’s growth trajectory.

Sustainable Aviation Fuel Market Report Highlights

- By region, North America led the sustainable aviation fuel (SAF) market with the largest revenue share of over 47.11% in 2025.

- By feedstock type, the vegetable oils segment led the market with the largest revenue share of 36.11% in 2025.

- By feedstock type, the waste oils and fats segment is expected to grow with a 25% industry share during the forecast period.

- By processing technology, the hydro processed esters and fatty acids (HEFA) led the market with the largest revenue share of 41.23% in 2025.

- By processing technology, the Fischer-Tropsch (FT) synthesis segment is expected to grow with a 25% industry share during the forecast period.

- By application, the commercial aviation segment accounted for the largest revenue share of 71.09% in 2025.

- By application, the private and business aviation segment is expected to have with 10% industry share during the forecast period.

- By distribution channel, the direct sales to airlines segment dominated with the largest revenue share of 60.56% in 2025.

- By distribution channel, the fuels blending/ suppliers segment is expected to grow with a 25% industry share during the forecast period.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

What are the benefits of SAF compared to fossil jet fuel?

Based on our own Life Cycle Analysis, a specific batch of SAF can reduce emissions around 87%, compared to fossil jet fuel over its entire life span. This includes production, distribution, transportation and combustion. It can also reduce other harmful emissions like particulates and sulfur by 91% and 100% respectively. These reductions are critical ways to reduce the impact of climate change on our planet.

The Sustainable Aviation Fuel Market Outlook 2025

The Sustainable Aviation Fuel (SAF) Market Outlook, developed in close collaboration with ICF today. This year’s edition highlights both the progress made and the important steps still needed to ensure a resilient, scalable SAF industry capable of meeting long-term decarbonization goals.

The Sustainable Aviation Fuel Market Production

SAF can be produced from non-petroleum-based renewable feedstocks including, but not limited to, the food and yard waste portion of municipal solid waste, woody biomass, fats/greases/oils, and other feedstocks. SAF production is in its early stages, with three known commercial producers:

- World Energy began SAF production in 2016 at its Paramount, California, facility and initially supplied fuel to Los Angeles International Airport prior to supplying additional California airports.

- International producer Neste began supplying SAF to San Francisco International Airport in 2020 before expanding to other California airports in 2021 and 2022, as well as Aspen/Pitkin County Airport and Telluride Regional Airport, both in Colorado.

- Montana Renewables LLC began production in partnership with Shell at an existing petroleum production plant in 2023, supplying fuel to several partner airlines.

Additional new domestic plants are expected. Many airlines have signed agreements with existing and future SAF producers to use all their expected output. The U.S. Environmental Protection Agency (EPA) collects renewable fuel data as part of the Renewable Fuel Standard, which provides an approximate consumption for novel biofuels such as SAF. EPA's data show that approximately 5 million gallons of SAF were consumed in 2021, 15.84 million gallons in 2022, and 24.5 million gallons in 2023.

There are multiple technology pathways to produce fuels approved by ASTM and blending limitations based on these pathways. ASTM D7566 Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons dictates fuel quality standards for non-petroleum-based jet fuel and outlines approved SAF-based fuels and the percent allowable in a blend with Jet A. All three existing plants use the hydroprocessed esters and fatty acids pathway shown in the table on this page. New domestic plants using the alcohol-to-jet pathway with ethanol as a feedstock are expected. ASTM D1655 Standard Specification for Aviation Turbine Fuels allows co-processing of biomass feedstocks at a petroleum refinery in blends up to 5%.

Both ASTM standards are continuously updated to allow for advancements in technology to produce SAF. DOE's Sustainable Aviation Fuel Review of Technical Pathways provides details on various SAF production pathways. The pathways below represent only those currently approved by ASTM. Processes and tests exist for the approval of other feedstocks, fuel molecules, and blending limits, and the types of approved fuels will increase as these are evaluated through this process.

| SAF Production Pathways | |||||

| Pathway | Approved Name | Blending Limitation | Feedstocks | Chemical Process | |

| Fischer-Tropsch (FT) Synthetic Paraffinic Kerosene (SPK) | FT-SPK, ASTM D7566 Annex A1, 2009 | 50 | % | Municipal solid waste, agricultural and forest wastes, energy crops | Woody biomass is converted to syngas using gasification, then a Fischer-Tropsch synthesis reaction converts the syngas to jet fuel. Feedstocks include various sources of renewable biomass, primarily woody biomass such as municipal solid waste, agricultural wastes, forest wastes, wood, and energy crops. ASTM approved in June 2009 with a 50% blend limit. |

| Hydroprocessed Esters and Fatty Acids | HEFA-SPK, ASTM D7566 Annex A2, 2011 | 50 | % | Oil-based feedstocks (e.g., jatropha, algae, camelina, and yellow grease) | Triglyceride feedstocks such as plant oil; animal oil; yellow or brown greases; or waste fat, oil, and greases are hydroprocessed to break apart the long chain of fatty acids, followed by hydroisomerization and hydrocracking. This pathway produces a drop-in fuel and was ASTM approved in July 2011 with a 50% blend limit. |

| Hydroprocessed Fermented Sugars to Synthetic Isoparaffins | HFS-SIP, ASTM D7566 Annex A3, 2014 | 10 | % | Sugars | Microbial conversion of sugars to hydrocarbons. Feedstocks include cellulosic biomass feedstocks (e.g., herbaceous biomass and corn stover). Pretreated waste fat, oil, and greases also can be eligible feedstocks. ASTM approved by ASTM in June 2014 with a 10% blend limit. |

| FT-SPK with Aromatics | FT-SPK/A, ASTM D7566 Annex A4, 2015 | 50 | % | Same as A1 | Biomass is converted to syngas, which is then converted to synthetic paraffinic kerosene and aromatics by FT synthesis. This process is similar to FT-SPK ASTM D7566 Annex A1, but with the addition of aromatic components. ASTM approved in November 2015 with a 50% blend limit. |

| Alcohol-to-Jet Synthetic Paraffinic Kerosene | ATJ-SPK, ASTM D7566 Annex A5, 2016 | 50 | % | Cellulosic biomass | Conversion of cellulosic or starchy alcohol (isobutanol and ethanol) into a drop-in fuel through a series of chemical reactions—dehydration, hydrogenation, oligomerization, and hydrotreatment. The alcohols are derived from cellulosic feedstock or starchy feedstock via fermentation or gasification reactions. Ethanol and isobutanol produced from lignocellulosic biomass (e.g., corn stover) are considered favorable feedstocks, but other potential feedstocks (not yet ASTM approved) include methanol, iso-propanol, and long-chain fatty alcohols. ASTM approved in April 2016 for isobutanol and in June 2018 for ethanol with a 30% blend limit. |

| Catalytic Hydrothermolysis Synthesized Kerosene | CH-SK or CHJ, ASTM D7566 Annex A6, 2020 | 50 | % | Fatty acids or fatty acid esters or lipids from fat oil greases | (Also called hydrothermal liquefaction), clean free fatty acid oil from processing waste oils or energy oils is combined with preheated feed water and then passed to a catalytic hydrothermolysis reactor. Feedstocks for the CH-SPK process can be a variety of triglyceride-based feedstocks such as soybean oil, jatropha oil, camelina oil, carinata oil, and tung oil. ASTM approved in February 2020 with a 50% blend limit. |

| Hydrocarbon-Hydroprocessed Esters and Fatty Acids | HC-HEFA-SPK, ASTM D7566 Annex A7, 2020 | 10 | % | Algal oil | Conversion of the triglyceride oil, derived from Botryococcus braunii, into jet fuel and other fractionations. Botryococcus braunii is a high-growth alga that produces triglyceride oil. ASTM approved in May 2020 with a 10% blend limit. |

| Fats, Oils, and Greases (FOG) Co-Processing | FOG Co-Processing ASTM D1655 Annex A1 | 5 | % | Fats, oils, and greases | ASTM approved 5% fats, oils, and greases coprocessing with petroleum intermediates as a potential SAF pathway. Used cooking oil and waste animal fats are two other popular sources for coprocessing. |

| FT Co-Processing | FT Co-Processing ASTM D1655 Annex A1 | 5 | % | FT biocrude | In association with the University of Dayton Research Institute, ASTM approved 5% Fischer-Tropsch syncrude coprocessing with petroleum crude oil to produce SAF. |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6066

Sustainable Aviation Fuel: Safe, Reliable, Low Carbon

SAF is a biofuel used to power aircraft that has similar properties to conventional jet fuel but with a smaller carbon footprint. Depending on the feedstock and technologies used to produce it, SAF can reduce emissions dramatically compared to conventional jet fuel. Some emerging SAF pathways even have a net-negative emissions footprint.

SAFs lower carbon intensity makes it an important solution for reducing emissions, which make up 9%–12% of U.S. transportation emissions, according to the U.S. Environmental Protection Agency.

A Menu of Feedstocks for Producing SAF

The U.S. Department of Energy’s 2023 Billion-Ton Report: An Assessment of U.S. Renewable Carbon Resources concluded that the United States could triple its production of biomass to more than 1 billion tons per year producing an estimated 60 billion gallons of low emission liquid fuels. These resources include:

- Corn grain

- Oil seeds

- Algae

- Other fats, oils, and greases

- Agricultural residues

- Forestry residues

- Wood mill waste

- Municipal solid waste streams

- Wet wastes (manures, wastewater treatment sludge)

- Dedicated energy crops.

This vast resource contains enough feedstock to meet the projected fuel demand of the U.S. aviation industry, additional volumes of drop-in low carbon fuels for use in other modes of transportation, and produce high-value bioproducts and renewable chemicals.

SAF Benefits Beyond Lowering Emissions

SAF developed from a wide dispersion and variety of biomass resources will ensure that the benefits of expanded biomass production extend to both rural and urban areas. Resources, like energy crops, in a future mature market can provide more than 400 million tons of biomass per year above current uses. In addition, expanding biomass production can create new economic opportunities in agricultural and urban communities, improve the environment, and even boost aircraft performance.

Extra Revenue for Farmers

By growing biomass crops for SAF production, American farmers can earn more money during off seasons by providing feedstocks to this new market, while also securing benefits for their farms like reducing nutrient losses and improving soil quality.

Environmental Services

Biomass crops can control erosion and improve water quality and quantity. They can also increase biodiversity and store carbon in the soil, which can deliver on-farm benefits and environmental benefits across the country. Producing SAF from wet wastes, like manure and sewage sludge, reduces pollution pressure on watersheds, while also keeping potent methane gas out of the atmosphere.

Improved Aircraft Performance

Many SAFs contain fewer aromatic components, which enables them to burn cleaner in aircraft engines. This means lower local emissions of harmful compounds around airports during take-off and landing. Aromatic components are also precursors to contrails, which can exacerbate environmental impacts.

Biofuels Production Supports American Jobs

The United States is the largest producer of biofuels in the world, which contributes to our domestic economy, creates jobs, and reduces emissions.

Expanding domestic SAF production can help sustain the benefits of our biofuel industry and forge new economic benefits, creating and securing employment opportunities across the country. These include jobs in:

- Feedstock production in farming communities

- Construction for building cutting-edge biorefineries

- Manufacturing for operating SAF biorefineries and infrastructure

Government Initiatives for the Sustainable Aviation Fuel (SAF) Industry:

- ReFuelEU Aviation Initiative (European Union): This policy mandates that aviation fuel suppliers at EU airports must blend a minimum share of SAF with conventional jet fuel, starting at 2% in 2025 and increasing to 70% by 2050, to create a guaranteed market and drive investment.

- Sustainable Aviation Fuel Grand Challenge (United States): A government-wide strategy to expand domestic SAF production, setting an ambitious goal of achieving 3 billion gallons per year by 2030 and 35 billion gallons by 2050 to meet 100% of domestic aviation fuel demand.

- Inflation Reduction Act (IRA) Tax Credits (United States): The IRA provides significant production tax credits (45Z Clean Fuel Production Credit) to incentivize the production of clean transportation fuels, including SAF, and help bridge the price gap with conventional jet fuel.

- National SAF Blending Targets (India): India has approved indicative blending targets for SAF in aviation turbine fuel, starting with 1% by 2027, 2% by 2028, and 5% by 2030 for international flights, to promote self-reliance and decarbonization.

- Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) (ICAO): This global market-based measure, established by the International Civil Aviation Organization, requires airlines to offset emissions above a set baseline from international flights, thereby creating a demand signal for SAF use.

- UK SAF Mandate (United Kingdom): Similar to the EU, the UK has introduced a mandate requiring fuel suppliers to ensure a minimum proportion of the UK's aviation fuel mix is SAF, starting at 2% in 2025 and rising to 10% by 2030.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6066

Sustainable Aviation Fuel Market Report Scope

| Report Attribute | Details |

| Market size value, in 2026 | USD 3.82 Billion |

| Revenue forecast in 2035 | USD 357.41 Billion |

| Growth rate | CAGR of 65.56% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Volume in million liters, revenue in USD million, and CAGR from 2025 to 2035 |

| Report coverage | Volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Feedstock Type, By Process Technology, By Application / End-Use, By Distribution Channel, By Region |

| Region scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | Aemetis Inc., AVFUEL CORPORATION, Fulcrum BioEnergy, Gevo, TotalEnergies, LanzaTech, Neste, Preem AB, Sasol Limited, SkyNRG B.V., World Energy, LLC |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Major Trends in the Sustainable Aviation Fuel (SAF) Market?

- Emergence of multi-feedstock, multi-pathway biorefineries enabling flexible production using vegetable oils, waste oils, biomass, and other renewable materials.

- Increasing regulatory support and adoption of SAF credits and blending mandates, driving predictable demand and investment in SAF infrastructure.

- Growing shift from conventional jet fuel toward SAF in commercial aviation, with expanding interest from private/business aviation and defence sectors.

- Rapid development and scaling of advanced conversion technologies are broadening the feedstock base beyond traditional oils and improving sustainability.

How Does AI Influence the Growth of the Sustainable Aviation Fuel (SAF) Industry in 2025?

Artificial intelligence supports the growth of the sustainable aviation fuel industry by enhancing efficiency across the entire SAF value chain. AI helps optimise feedstock selection by analysing large datasets in crop yields, waste availability, and environmental impact, allowing producers to identify the most sustainable and cost-effective raw materials. In production, AI-driven process optimisation improves conversion efficiency, reduces energy use, and minimises operational disruptions in biorefineries. AI also strengthens supply chain planning by forecasting demand, managing logistics, and assuring consistent SAF quality that meets aviation standards.

Market Opportunity

Could AI Make SAF Cheaper and Easier to Produce?

AI-powered tools can pick the best feedstocks and optimise conversion pathways in real time, which can lower production costs and make sustainable aviation fuel more economically viable than conventional jet fuel.

Could Smarter Supply Chains Boost SAF Availability Everywhere?

AI-based supply chain systems can forecast feedstock availability and manage logistics more reliably, helping ensure consistent raw material supply and stable SAF production even when waste materials or biomass sources fluctuate.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6066

Sustainable Aviation Fuel Market Segmentation Insights

Processing Technology Insights:

Which Processing Technology Segment Led the Sustainable Aviation Fuel (SAF) Market in 2025?

The hydroprocessed esters and fatty acids (HEFA) led the market due to its technical maturity, strong certification history, and compatibility with existing refinery systems. This technology allows producers to deliver high-quality SAF that meets stringent aviation standards without requiring new infrastructure. Its reliability has earned widespread adoption among major producers, making it the foundation of current SAF supply. The scalability of HEFA and its compatibility with multiple feedstocks reinforce its central position in the market.

The Fischer-Tropsch (FT) synthesis segment is gaining rapid growth because it enables the use of a very broad range of renewable and waste-based feedstocks, including municipal solid waste and biomass residues. This flexibility makes FT an important solution for countries aiming to diversify their SAF production base. The technology produces high-purity synthetic fuels that align well with global decarbonisation strategies, attracting strong interest from both public and private sectors. FT systems are also being developed at larger scales, improving their long-term cost efficiency.

Application Insights:

Which Application Segment Held the Largest Share of the Sustainable Aviation Fuel (SAF) Market in 2025?

Commercial aviation dominates SAF usage because airlines have the highest fuel consumption and face the strongest pressure to reduce emissions. Major carriers are committing to long-term decarbonisation programs, which significantly increases SAF demand across global routes. Airports and fuel suppliers prioritize commercial fleets when establishing SAF infrastructure, making this segment the central driver of market activity.

Private and business aviation is expanding fastest in the market as operator’s face increasing sustainability expectations from corporate travellers and regulatory bodies. These fleets often adopt new fuels more quickly due to greater operational flexibility and higher willingness to invest in premium, low-carbon solutions. Many private aviation companies are integrating SAF into service packages to enhance their environmental reputation.

By distribution channel Insights:

Which Distribution Channel Dominated the Sustainable Aviation Fuel (SAF) Market in 2025?

The direct sales to airlines dominate the SAF distribution landscape because airlines seek guaranteed supply agreements that support long-term decarbonisation planning. These direct contracts help secure pricing, availability, and quality, which are essential for large carriers managing global operations. Producers also prefer direct arrangements because they streamline logistics and simplify certification. As airlines expand SAF commitments, direct purchasing continues to strengthen their control over clean-fuel adoption. This channel remains the primary route for large-volume SAF transactions.

The fuel blending/supplier segment is growing fastest as they make SAF more accessible to a wider range of airports and smaller carriers. This approach integrates SAF into existing fuel-handling systems, reducing infrastructure challenges and making distribution more flexible. Blending also supports incremental adoption, allowing airports to gradually scale SAF availability across terminals. As more suppliers participate in the ecosystem, the reach of SAF widens, improving market penetration. This trend is vital for expanding SAF adoption beyond major hubs and into broader regional markets.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Could North America’s Mature Aviation Infrastructure Keep North America at the Centre of The SAF Boom?

The North America sustainable aviation fuel (SAF) market size was valued at USD 1.09 billion in 2025 and is expected to reach USD 168.59 billion by 2035, growing at a CAGR of 65.58% from 2026 to 2035. In 2025, North America dominated the sustainable aviation fuel (SAF) market with a 47.11% industry share, owing to the presence of one of the world's largest and advanced aviation production units in the current period.

The U.S. government's initiatives, such as the Inflation Reduction Act and the Sustainable Skies Act, provide tax credits and subsidies that incentivize SAF production and adoption. State-level programs such as California's Low Carbon Fuel Standard further bolster these efforts. Major airlines, including United, Delta, and American Airlines, have entered into long-term agreements with SAF producers such as Neste, World Energy, and LanzaJet to secure sustainable fuel supplies. Technologies such as Hydroprocessed Esters and Fatty Acids (HEFA), Alcohol-to-Jet (AtJ), and Fischer-Tropsch synthesis are being employed to convert various feedstocks into SAF, enhancing production capabilities.

North America remains the most established region for sustainable aviation fuel (SAF), supported by long-standing aviation infrastructure, well-developed supply chains, and early adoption of SAF by carriers and fuel producers. The region’s supportive regulatory environment and investments in SAF production capacity have made it the primary hub for SAF deployment globally.

U.S. Sustainable Aviation Fuel (SAF) Market Trends

The U.S. dominates within North America due to its extensive refining infrastructure and access to diverse feedstocks, which allow SAF producers to scale up production. Growing investments in SAF blending and storage facilities at major U.S. airports and refineries reinforce its role as a key supply centre for clean aviation fuel.

Could Asia-Pacific’s Surge in Aviation Demand Push SAF to Centre Stage?

The Asia-Pacific region is experiencing very rapid growth in its sustainable aviation fuel (SAF) market as air travel surges and environmental pressure rises. Many countries in the region are investing heavily in SAF production capacity, and airlines are increasingly open to adopting SAF to meet sustainability goals, making the Asia-Pacific a hotbed for future SAF expansion.

China Sustainable Aviation Fuel (SAF) Market Trends

Within the Asia-Pacific, China stands out as the dominant player. Its vast domestic aviation network, large passenger base, and expanding refinery infrastructure give it a strong advantage for SAF uptake. Ongoing projects to convert local waste oils and residues into SAF further reinforce its position as a potential regional SAF hub.

Europe Sustainable Aviation Fuel Market Trends

The European Sustainable Aviation Fuel (SAF) market is experiencing significant growth, driven by stringent environmental regulations and ambitious decarbonization targets set by the European Union. The ReFuelEU Aviation initiative mandates a progressive increase in SAF blending, starting at 2% in 2025 and aiming for 70% by 2050, to reduce greenhouse gas emissions in the aviation sector. This regulatory framework is complemented by national policies and incentives across member states, fostering investments in SAF production and infrastructure.

Latin America Sustainable Aviation Fuel Market Trends

The SAF market in Latin America is gaining momentum, propelled by the region's abundant biomass resources, supportive policy frameworks, and increasing international investments. Countries like Brazil, Colombia, and Chile are leading the charge. Brazil, for instance, has attracted a USD 1 billion investment from China's Envision Energy to produce SAF from sugarcane. Brazil's development bank, BNDES, and funding agency FINEP have also committed another USD 1 billion to SAF projects, focusing on research and technological development. Chile aims to establish its first large-scale SAF plant by 2030, targeting to meet half of its aviation fuel demand with SAF by 2050. Colombia is also making strides, with state-owned energy company Ecopetrol planning to invest up to $700 million in a new SAF production facility.

Middle East & Africa Sustainable Aviation Fuel Market Trends

The Middle East & Africa is increasingly positioning itself as a pivotal player in the SAF market, propelled by its strategic location, robust aviation sector, and ambitious sustainability goals. Countries such as the UAE and Saudi Arabia are integrating SAF into their broader decarbonization strategies, such as the UAE's Net Zero 2050 and Saudi Arabia's Vision 2030. These initiatives are complemented by investments in renewable energy infrastructure, including solar and wind projects, which can supply the necessary power for SAF production processes such as Power-to-Liquid (PtL) and Electrofuels (eFuels). Major regional carriers, including Emirates, Qatar Airways, and Etihad, are actively exploring SAF adoption, evidenced by Emirates' successful test flight of a Boeing 777 powered by SAF in January 2023. This growing momentum underscores the region's commitment to reducing aviation-related carbon emissions and fostering sustainable growth in the aviation sector.

Top Companies in the Sustainable Aviation Fuel (SAF) Market & Their Offerings:

- TotalEnergies: Produces and supplies SAF as part of its goal to become a major player in the energy transition, using various feedstocks in its European refineries.

- LanzaJet: Uses proprietary Alcohol-to-Jet (AtJ) technology to convert low-carbon ethanol from waste sources into drop-in SAF and renewable diesel.

- World Energy: Was the first company to produce SAF commercially and is a major producer focused on delivering net-zero fuels from renewable agricultural inputs and waste oils.

- Neste: A global leader in renewable fuels specializing in producing SAF from sustainably sourced waste and residue raw materials, such as used cooking oil and animal fats.

- Shell Aviation: Invests in SAF production, the development of various technology pathways, and strategic partnerships, including an investment in LanzaJet's AtJ technology.

- BP (British Petroleum): Its aviation arm, Air BP, has an established SAF supply chain and has supplied SAF at over 20 locations across three continents.

- ExxonMobil: A technology developer that is adapting existing methanol synthesis and conversion platforms for methanol-to-jet (MtJ) production pathways.

- Velocys: Focuses on developing plants using Fischer-Tropsch (FT) technology to convert sustainable biomass into renewable crude for SAF, though commercial operations have faced challenges.

- Gevo, Inc.: Focuses on the production of SAF from its proprietary Alcohol-to-Jet (AtJ) pathway, converting sustainably grown corn into isobutanol for renewable hydrocarbons.

- Red Rock Biofuels: Was founded to create SAF from woody biomass but has faced financial challenges and has not completed its plant or launched commercial operations.

-

Repsol: A pioneer in the manufacturing of SAF in Spain, producing advanced biofuels from waste at its industrial complexes to meet EU climate targets.

More Insights in Towards Chemical and Materials:

- Sustainable Plastics Market Size to Hit USD 1,448.23 Bn by 2034

- Sustainable EPDM Market Volume to Reach 2,61,364.2 Tons by 2034

- Construction Chemicals Market Size to Reach USD 72.7 Billion by 2034

- Lubricants Market Size to Reach USD 211.53 Billion by 2034

- Propylene Glycol Market Size to Hit USD 9.61 Billion by 2034

- Sustainable Adhesive Market Leads USD 4.19 Bn at 5.4% CAGR

- Sustainable Catalysts Market Size to Surpass USD 16.54 Bn by 2035

- Sustainable Materials Market Size to Hit USD 1078.35 Bn by 2034

- Asia Pacific Sustainable Chemicals Market Size to Surge USD 59.74 Bn by 2034

- U.S. Sustainable Chemicals Market Size to Hit USD 30.59 Billion by 2034

- Sustainable Construction Material Market Size to Surpass USD 483.73 Bn by 2025

- Nanochemicals Market Size to Surpass USD 43.93 Billion by 2035

- Organic Fertilizers Market Size to Hit USD 23.35 Billion by 2035

- Green Fertilizer Market Size to Exceed USD 7.88 Billion by 2035

- Smart Fertilizers Market Size to Reach USD 6.56 Billion by 2035

- Plastic Resin Market Size to Surpass USD 1,384.76 Billion by 2035

- Liquid Fertilizers Market Size to Worth USD 4.93 Billion by 2035

- Agriculture Fertilizers Market Size to Surpass USD 332.79 Billion by 2035

-

Thermoplastic Polyimides Market Size to Hit USD 1,926.61 Mn by 2035

Sustainable Aviation Fuel Market Top Key Companies:

- Aemetis Inc.

- AVFUEL CORPORATION

- Fulcrum BioEnergy

- Gevo

- TotalEnergies

- LanzaTech

- Neste

- Preem AB

- Sasol Limited

- SkyNRG B.V.

- World Energy, LLC

What is Going Around the Global Sustainable Aviation Fuel (SAF) Industry?

- In August 2025, Indian oil corporation (IOC) signed a MoU with Air India to supply SAF produced from used cooking oil at its Panipat refinery, marking a milestone in India’s move toward cleaner aviation. The refinery recently became the first in the country to receive global certification for SAF production, underscoring India’s commitment to green aviation.

- In March 2025, Airbus launched a “Book and Claim” SAF initiative to make SAF more accessible globally, enabling airlines to claim emissions reductions even if the fuel is supplied elsewhere. Simultaneously, coach group Cathay Group and Airbus announced a co-investment partnership to expand mature SAF production technologies, highlighting industry wide momentum toward sustainable aviation.

Sustainable Aviation Fuel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Sustainable Aviation Fuel Market

By Feedstock Type

- Vegetable Oils

- Soybean Oil

- Rapeseed Oil

- Palm Oil

- Waste Oils & Fats

- Used Cooking Oil

- Animal Fats

- Sugar & Starch-Based

- Sugarcane

- Corn

- Algae-Based

- Microalgae

- Lignocellulosic Biomass

- Wood Residues

- Agricultural Residues

- Other Feedstocks

- Municipal Solid Waste

- Municipal Solid Waste

By Process Technology

- Hydroprocessed Esters and Fatty Acids (HEFA)

- Fischer-Tropsch (FT) Synthesis

- Alcohol-to-Jet (ATJ)

- Direct Sugars-to-Hydrocarbons (DSHC)

- Other Technologies

By Application / End-Use

- Commercial Aviation

- Military / Defense Aviation

- Private & Business Aviation

- Other Applications

By Distribution Channel

- Direct Sale to Airlines

- Fuel Blending / Suppliers

- Government Programs & Mandates

- Other Channels

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6066

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.